Converting 401k to roth ira calculator

You will have to pay taxes on the money you convert. You can choose to roll pretax savings into a Roth IRA but doing so would be treated as a taxable event.

Roth Ira Calculator Roth Ira Contribution

You must note that when you convert to a Roth IRA you must pay income tax on the otherwise taxable amount of.

. Though in reality there are a few key differences between the two that are important to understand. And the Roth component of a Roth 401k gives you the benefit of tax-free. Consider a Roth IRA conversion.

When it comes to a Roth Individual Retirement Account Roth IRA the answer could be yes. You are age 59½ or older. A Roth IRA is funded with after-tax dollars and qualified withdrawals are entirely tax-free.

You become disabled or have passed away. You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401k into a Roth IRA. Thats because Roth retirement accounts are funded with after-tax dollars while traditional 401ks are funded with pre-tax dollars.

You can convert a Traditional IRA to a Roth IRA at any time. Talk to a financial adviser or your 401k plan administrator to determine the best strategy for you if you have a combination of investment accounts. Calculate Anything Anytime.

How To Protect 401k and IRA Against a Stock Market Crash. If youre still saving for retirement you could also consider converting a portion of your 401k to a Roth IRA. First place your contribution in a traditional IRAwhich has no income limits.

The conversion would be part of a 2-step process often referred to as a backdoor strategy. In addition to a Traditional 401k and Roth 401k some providers offer an after-tax 401k. Its important that these be direct rollovers and not 60-day indirect rollovers.

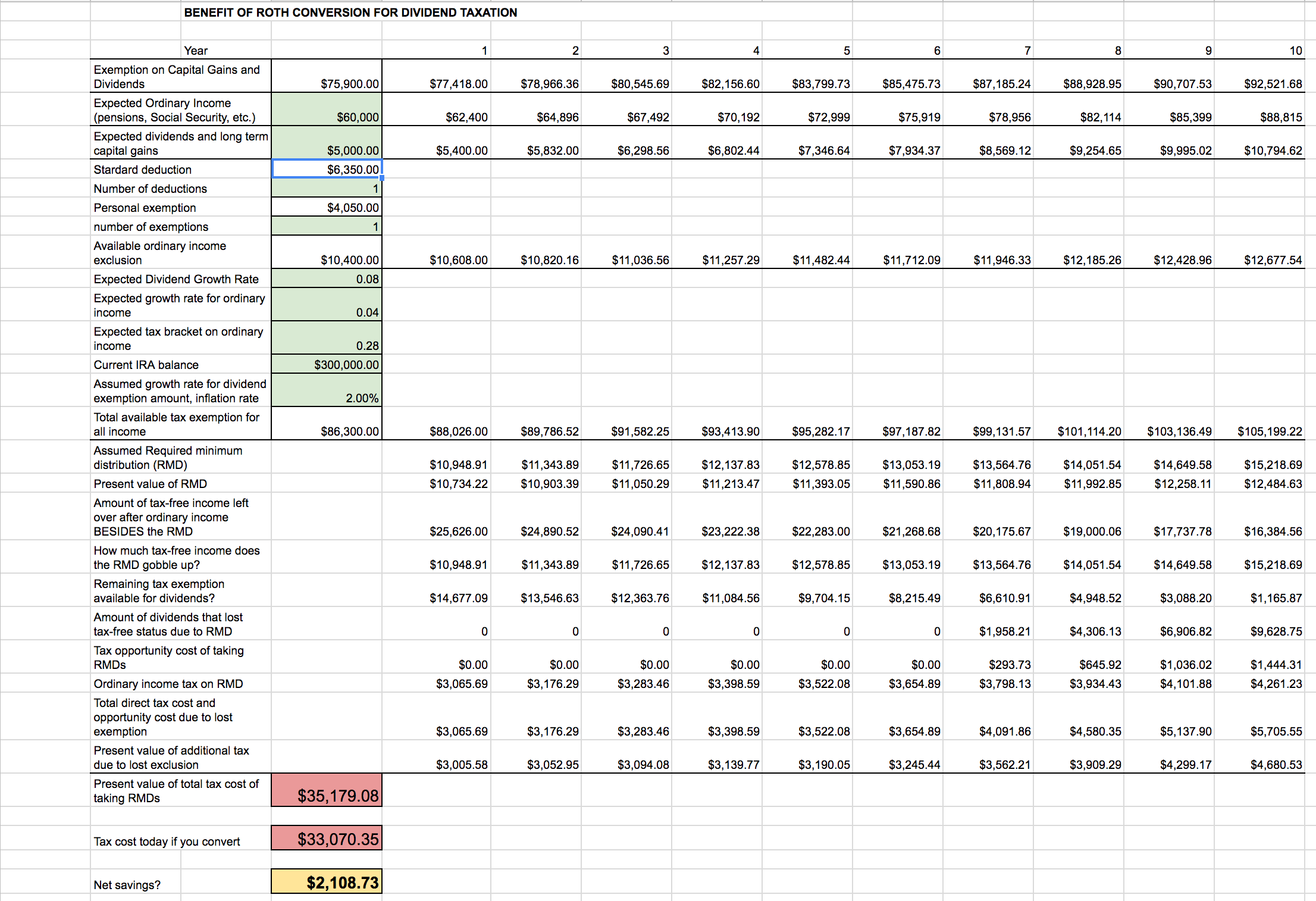

1 Additionally Roth IRAs arent subject to required minimum distributions RMDs which gives you greater control over your taxable income in retirement. Then move the money into a Roth IRA using a Roth conversion. Wanna calculate your net worth at 3 in the morning or calculate your one rep weight lifting max after your afternoon workout or even calculate how much tile you need before starting your weekend bathroom remodeling project.

With a Roth 401k you can take advantage of the company match on your contributions if your employer offers onejust like a traditional 401k. A Roth IRA conversion is a way to move money from a traditional SEP or SIMPLE IRA or a defined-contribution plan like a 401k into a Roth IRA. At first glance you might think Roth and after-tax 401k are the same thing since both have contributions made with after-tax dollars.

We are so committed to providing online calculators to calculate answers to anything imaginable that if. After-tax assets Roth 401k or after-tax savings are rolled into a Roth IRA. You will owe tax on the amount of your Roth conversion in the year that you convert but you likely wont owe any additional taxes during your lifetime.

What You Should Know About Converting Costs. For instance if you expect your income level to be lower in a particular year but increase again in later years you can initiate a Roth conversion to capitalize on the lower income tax year and then let that money grow tax-free in your Roth IRA account. Converting to a Roth IRA may ultimately help you save money on income taxes.

A conversion can get you into a Roth IRAeven if your income is too high. Roll over to a Wells Fargo IRA in 3 easy steps. Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

The Roth IRA has been in existence for at least five years. Get a FREE Quote. You might also consider converting a traditional IRA to a Roth IRA before or during retirement.

This can help set you up to be more tax. For your business there is a one-time setup fee of 100 for new plans and 100 for converting an existing 401k plan to a Merrill plan. Once the plan is set up the monthly administration fee is 20 or 25 depending on total plan assets.

Please verify with your plan administrator that your distribution is eligible for a rolloverconversion. Choose an IRA transfer funds from your 401k and manage your savings. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement.

That direct rollover would be a taxable Roth conversion. Long-Term Care Menu Toggle. Again a financial professional can outline whether this makes sense depending on your needs and goals.

Converting a traditional 401k to a Roth IRA is similar to rolling over your 401k to a traditional IRA with one extra step. The Roth 401k was introduced in 2006 and combines the best features from the traditional 401k and the Roth IRA. To contribute to a Roth IRA in 2022 single tax filers must have a modified adjusted gross income MAGI of 144000 or less up from.

The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible and contributions not earnings may be withdrawn tax-free. A direct rollover means that your 401k funds will be transferred directly from your 401k to your traditional IRA and Roth IRA without you touching the funds in between. Similarly you can roll after-tax savings into a traditional IRA but this requires careful tracking of your assets for when you start taking distributions.

Roth Ira Calculators

Systematic Partial Roth Conversions Recharacterizations

Roth Ira Conversion Spreadsheet Seeking Alpha

Traditional Vs Roth Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculators

Roth Conversion Q A Fidelity

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management